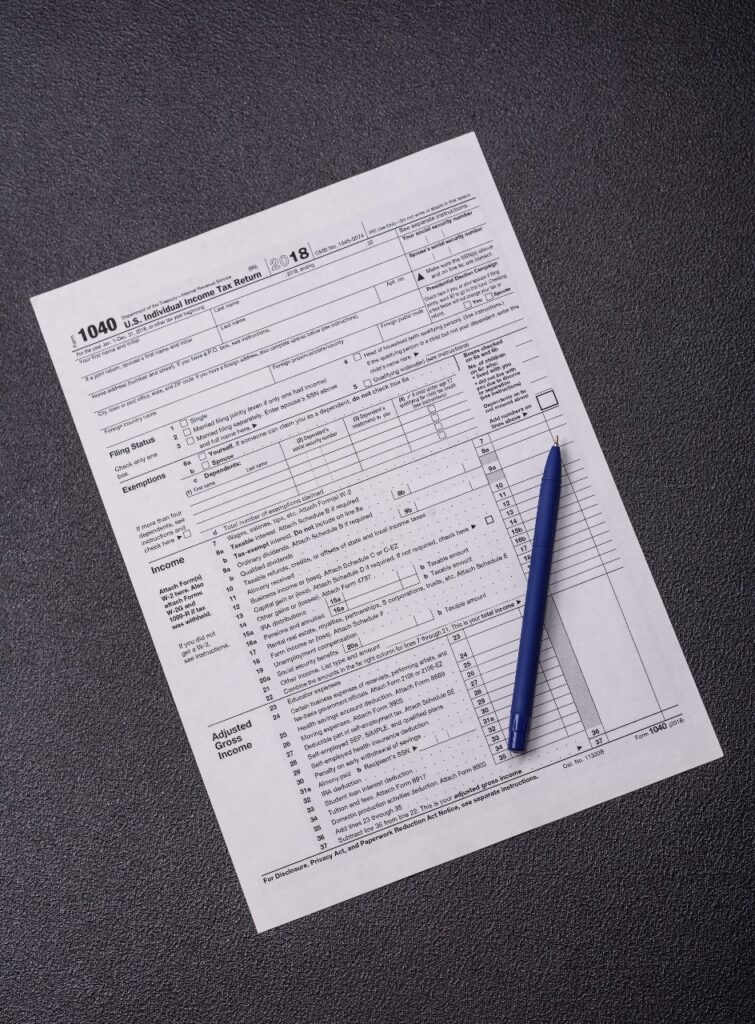

1040 FORM

Edit and Modify Tax 1040 Form

When it comes to filing your US Tax 1040 Form, it’s important to make sure all the information is accurate and up-to-date. However, mistakes can happen, which is why it’s important to know how to edit and modify your 1040 form online.

The process for editing and modifying your 1040 form will depend on the service you are using. However, in general, you should be able to access your previously filed return and make any necessary changes. For example, if you realize that you made a mistake on your income or deductions, you can go back and correct it.

One common mistake made when filling out 1040 forms is miscalculating income or deductions. This can lead to incorrect tax liability or even penalties and fines. It’s important to double-check your math and use tools such as tax calculators to help ensure accuracy.

Another common error is failing to include all necessary schedules and forms. For example, if you have rental income, you may need to file Schedule E. If you have child tax credits, you may need to file Schedule 8812. And if you have qualified business income, you may need to file Form 8995. Failing to include these schedules and forms can lead to errors and delays in processing your return.

Retail Companies Paystub: 711 is a convenience store chain that gives its employees a pay stub 711 paystub is proof of employee income. Here we satisfactory offers to edit and create 711 paystub and other retail companies in the ADP version. We also give a discount to our customers.

Health Companies Paystub: Walgreens is a company of health that uses Walgreens paystub as a document that shows an employee’s earnings and deductions. We provide an advanced service for editing paystubs of many health companies at in affordable prices.

WHAT DOES A PAY STUB HAVE TO INCLUDE?

- Correcting errors on a US Tax 1040 Form

is an important step to avoid penalties and fines. While it’s best to avoid errors in the first place by carefully reviewing all information before submitting, sometimes mistakes can happen. Fortunately, there is a process for correcting errors on a 1040 form.

- The first step is to identify the error that needs to be corrected.

Common errors on 1040 forms include incorrect Social Security numbers, math errors, incorrect filing status, and missed deductions or credits.

- Once the error has been identified, the next step is to fill out Form 1040X

also known as the Amended U.S. Individual Income Tax Return. This form is used to correct errors on previously filed 1040 forms. It’s important to note that Form 1040X can only be used to correct errors on tax returns filed within the last three years.

- When filling out Form 1040X,

be sure to provide all of the necessary information, including the tax year being amended, the original amounts reported on the original return, and the corrected amounts. Be sure to explain the reason for the amendment and attach any supporting documents.

- After completing Form 1040X

mail it to the appropriate address listed in the instructions. It’s important to note that amending a return may result in additional taxes owed or a refund due, so be sure to review the amended return carefully.

- Common errors and mistakes

made when filling out 1040 forms include errors on Schedule 2 line 2, tax computation worksheet, and Schedule D tax worksheet. It’s important to review these schedules carefully to avoid errors.

- If you’re unsure how to correct an error on your 1040 form

consider seeking the assistance of a tax professional to guide you through the process. Our website provides guidance on how to correct errors and file an amended tax return using form 1040X. Common errors that may require correction include incorrect social security numbers, incorrect calculation of tax, and incorrect filing status. Our team of experts is available to help you correct any errors and avoid the consequences of filing an incorrect tax return.

Frequently Asked Questions?

How do I edit my 1040 form?

To edit your 1040 form, you can use our US Tax 1040 Forms Create, Edit, & Modify Services Online. Simply upload your form and make the necessary changes using our user-friendly interface

What to Do If You Filed US Tax 1040 Form by Mistake?

If you filed a US Tax 1040 Form by mistake, it is important to take corrective action as soon as possible. Our website provides guidance on how to correct errors and file an amended tax return using form 1040X. It is important to file an amended return as soon as possible to avoid penalties and fines

Can I make my own 1040 form?

While it is possible to create your own 1040 form, we recommend using official IRS forms to ensure accuracy and compliance with tax laws. You can use our services to easily access and fill out these forms.

How do I correct an error on my 1040?

If you need to correct an error on your 1040 form, you can use our services to file an amended tax return using form 1040X. Our team of experts can assist you in making the necessary corrections and submitting the form to the IRS.

How do I edit my tax documents?

Our US Tax 1040 Forms Create, Edit, & Modify Services Online allows you to easily edit your tax documents online. Simply upload your form and make any necessary changes using our user-friendly interface.

How do I amend my 1040 online?

To amend your 1040 form online, you can use our services to file form 1040X. Our team of experts can assist you in making the necessary corrections and submitting the form to the IRS.

How do I edit a PDF tax form?

Our US Tax 1040 Forms Create, Edit, & Modify Services Online allows you to edit a PDF tax form online. Simply upload the PDF and make any necessary changes using our user-friendly interface.

Can a non US citizen file a 1040?

Non-US citizens who earn income in the United States may be required to file a 1040 form. Our team of experts can assist you in determining your tax obligations and filing the necessary forms

Who can file a 1040 Easy form?

The 1040EZ form is no longer available for use. However, taxpayers with simple tax situations may be eligible to use form 1040SR. Our team of experts can assist you in determining which form is appropriate for your situation.

Can 1040 be digitally signed?

Yes, 1040 forms can be digitally signed. Our US Tax 1040 Forms Create, Edit, & Modify Services Online allows you to sign your form electronically using a secure signature tool.

What happens if I filed 1040 by mistake?

If you filed a 1040 form by mistake, you may need to file an amended tax return using form 1040X. Our team of experts can assist you in making the necessary corrections and submitting the form to the IRS

Payment Methods We Accept

Eligibility for Filing 1040 Forms

US citizens, resident aliens, and nonresident aliens with US-source income are required to file specific 1040 forms based on their income and residency status.